Will the Gold Price Dip Further?

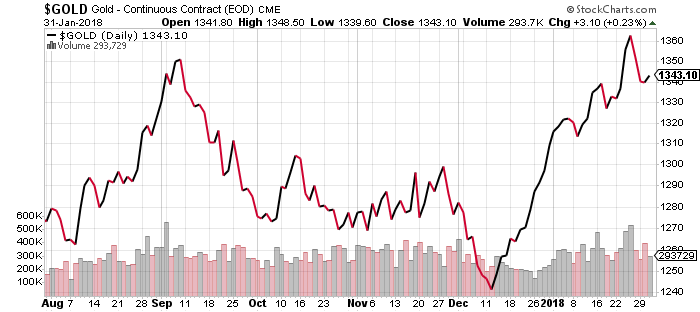

Despite a slight setback to the $1,340-$1,350 range, this isn’t a sign of gold prices dipping. Gold prices made a sharp comeback in the early weeks of January. After falling to a six-month low of $1,240 per ounce in December, they went all the way to $1,365 per ounce in the week of January 22.

Gold investors have sent a clear message; they are back and looking for safe assets. They have not bought into the stock market euphoria or the cryptocurrency mania that’s shown to have deep cracks at the seam. “Why is the gold price dipping?” is not a question that will get much traction this year.

Gold Investment 2018

There are two meta-trends contributing to gold’s rise. One is that the dollar is weak. President Donald Trump said he likes a strong dollar at the World Economic Forum at Davos, but his Secretary of the Treasury, Steve Mnuchin—whose job it is to oversee such matters—used the same international venue to indicate that the U.S. would pursue a weak dollar strategy. Then, just days after, Mnuchin backed down, saying a strong dollar is necessary. (Source: “Dollar bucks up on Mnuchin support for ‘strong’ greenback,” Financial Times, January 31, 2018.)

Mnuchin should not have said anything; the currency markets and investors, in general, would be right to wonder whether the winds of Washington suddenly took charge of the Department of the Treasury. The dollar index (DXY)—an algorithm based on the dollar’s performance against a basket of major currencies—has gone up slightly. Perhaps Trump and his administration want to confuse foreign trade partners, sending mixed—or highly confusing—signals. The strong dollar appeals to Trump as part of his “America First” or “Make America Great Again” narrative. But both Mnuchin and Trump are keen on giving American exports an advantage in foreign markets.

Gold Opportunity

Trump may also have reversed the narrative on the dollar to avoid foreign holders of the U.S. currency from demanding higher yields in the face of depreciation. (Source: “How Mnuchin’s words in Davos could send the US dollar spiralling,” South China Morning Post, January 30, 2018.)

Ultimately, the markets will decide which of the two stated policies is the right one. Still, given the uncertainty that Trump and Mnuchin have generated, the dollar can expect a bumpy ride. Moreover, it remains to be seen what the new Federal Reserve Chair Jerome Powell will do when he takes over from Janet Yellen in February. Will he risk a stock market correction by announcing another rate hike?

Given that the stock market’s performance in 2017 is the indicator about which Trump can boast most confidently, it’s unlikely another rate hike is coming so soon in 2018. This should maintain sell pressure against the dollar. As the gold price chart below suggests, gold may have entered a longer-term bullish phase; therefore, it may be riskier to stay out than getting in.

Goldman Sachs Group Inc (NYSE:GS) expected gold prices to fall early in 2018. They did the very opposite, throwing off many investors. The “gold buying rate” is clearly more bullish than Wall Street itself could have imagined. In fact, the bullish signals for gold had become evident as far back as the summer of 2017. President Trump’s State of the Union (SOTU) speech may have helped the stock market. Even there, though, the DJIA gained 0.28% after one of the most market-friendly SOTU speeches ever.

The fact is that the markets appear to have reached a ceiling. The ascent of the major indices has slowed down. The longest bull market in history—perhaps—may have finally slowed down to ponder its next move. Investors appear ready to take a break from the frenzy of risk-taking. One symptom of the re-emergence of risk-aversion is that U.S. Treasury yields are dropping.

Meanwhile, the Russiagate investigation appears to be reaching its climax. It’s unclear what the next moves between Mueller and Trump will be. But to gold investors, this is merely another signal to seriously consider gold. In times of uncertainty, gold is the safest asset by definition.